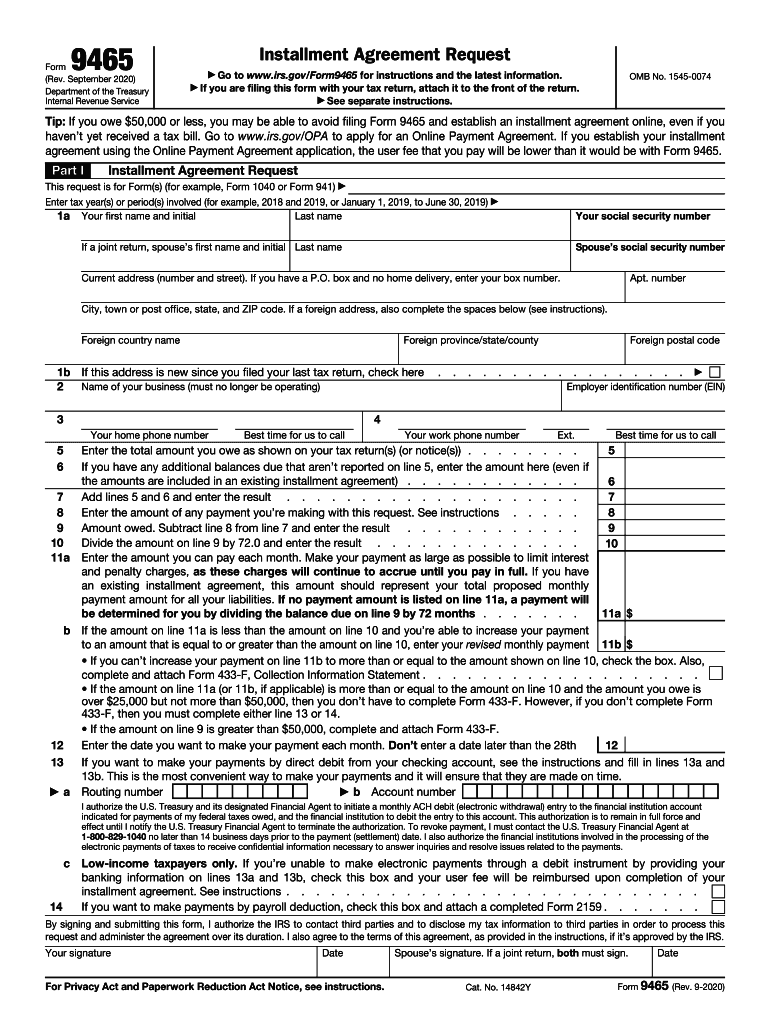

Who needs a form 9465?

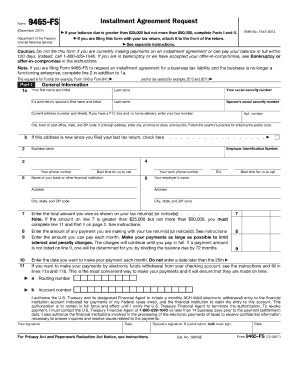

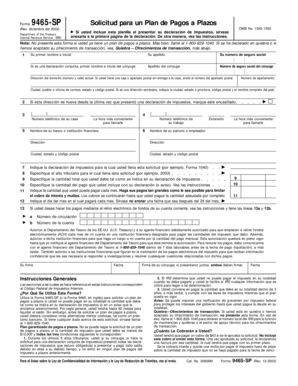

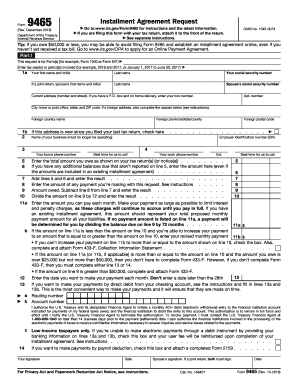

A person who can’t pay the full amount of debt (shown on their tax return), may request a monthly installment plan using the Form 9465. The maximum term for a streamlined agreement provided by the IRS for this type of cases is 72 months. It’s a chance to obtain extension of payments or to provide reasons for paying less than the applicant has owed. However, before requesting an installment agreement, the IRS recommends using other alternatives, such as getting a loan or using a credit on a credit card. Applicants should not use Form 433-F, if they can pay full amount within 120 days, or if their business is still operating and the company owes employment or unemployment taxes.

What is form 9465 for?

If the Installment Agreement Request is approved, a notice with the terms of new agreement will be given to an applicant. The notice will also specify whether an applicant is qualified for the reduced fee or not. You should also know that regardless of the IRS decision, you may still have to pay the fine for failure to pay taxes in a timely manner. If the agreement is signed, the applicant undertakes to make monthly payments instead of paying the entire amount of debt at once.

Is it accompanied by other forms?

It is usually accompanied by the form 433-F or 433-D.

When is form 9465 due?

You should keep in mind that Form 9465 is not to be filed within 120 days after the due date for the payment. It takes the IRS about 30 days to respond to this request.

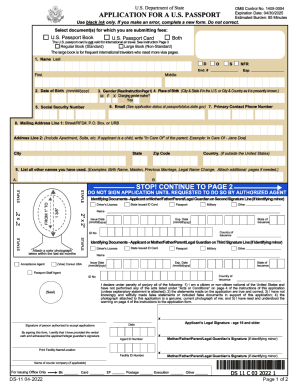

How do I fill out a form 9465?

This form consists of two parts. Each part specifies certain information about the nature of your debt. The following information should be provided in order to complete the form:

-

Submitter’s personal information and general information on reported business;

-

The amount you owed indicating the monthly amount you would pay;

-

Additional information which is meant to be provided only by those who have defaulted on an installment agreement within the past 12 months and the amount they owe is more than $25,000 but less than $50,000.

Where do I send it?

You can find the address for your state here.